Shore Pay Online: How the New Deposit Option Works

With our new feature, you can now easily activate deposits for online bookings through Shore Pay Online. This tool will help you reduce no-shows, increase planning security, and further automate your payment processes.

General Information About the New Feature

From now on, you can choose to make deposits mandatory for online bookings. When you enable this option, the deposit amount you select will be automatically charged at the time of booking.

The remaining balance will be automatically charged one hour before the appointment, using the payment method saved during the booking process.

💡 Objective: Increased security and less administrative work through fully automated payment processes.

Important Notes:

-

A deposit can only be set if online payment is made mandatory.

-

The deposit percentage can be selected in 10% increments (from 10% to 100%).

-

Currently, the entire payment process is fully automated online, including the collection of the remaining balance.

-

In the future, you will also be able to process the remaining balance through the Shore POS system.

👉 Here you can find the general article on Shore Pay Online.

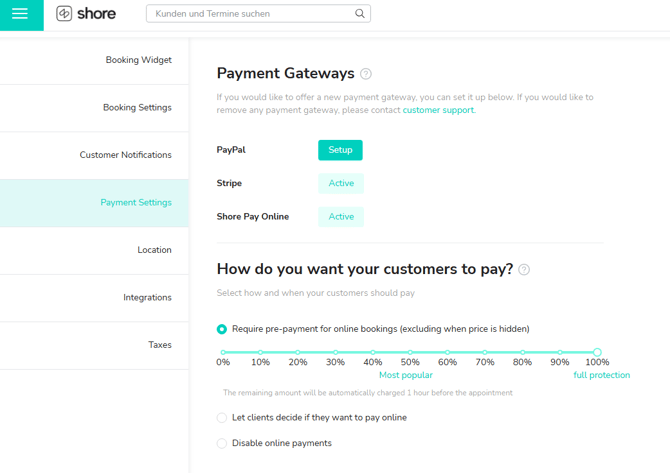

How to Activate the Feature

-

Log into your Shore account and go to Setup > Calendar Settings > Payment Settings.

-

Ensure that Shore Pay Online is activated.

-

Enable the "Require pre-payment for online bookings" option.

-

Choose the desired deposit percentage (between 10% and 100%).

-

Save your changes.

Once activated, the set deposit will automatically be charged for every online booking. The remaining balance will be automatically charged one hour before the appointment.

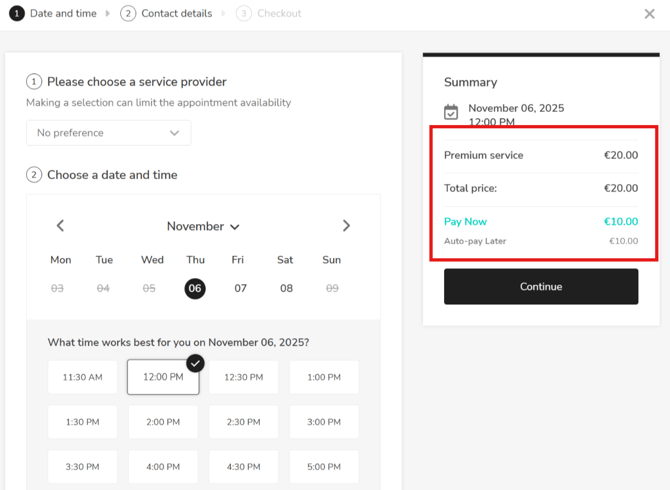

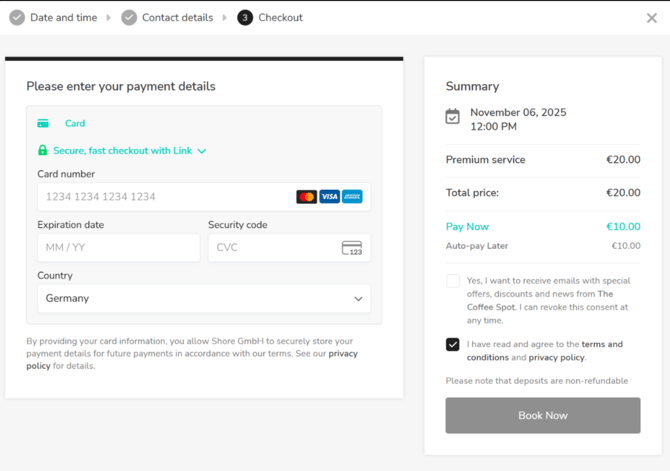

What Your Customers Will See During the Booking Process

When your customers make an online booking, they will see:

-

The total price of the appointment.

-

The deposit amount.

-

The remaining balance, which will be automatically charged.

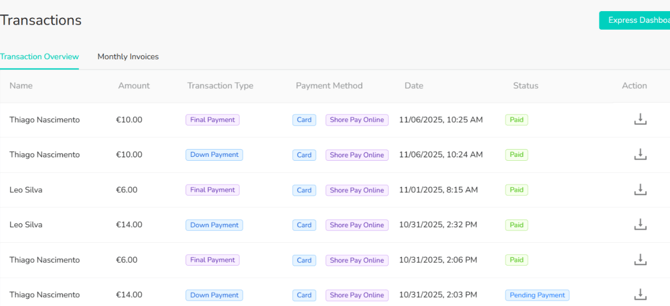

Transaction Overview

In the transaction overview, you can find:

-

All payments (deposits and remaining balances).

-

Clear labeling of each payment as either "deposit" or "remaining balance."

-

The invoices associated with each transaction.

This way, you'll always have a clear overview of all your bookings and transactions.

Additional Information

-

Refunds are still easily possible.

-

All transactions are transparent and can be viewed in the system.

-

Activation is done directly in your account via self-service.

-

A fee of 2.49% per transaction is applied.

-

Supported payment methods: Debit and credit cards.

-

Apple Pay and Google Pay .

Benefits for You as a Service Provider

-

Fewer No-Shows: Bookings become more binding and reliable.

-

Better Planning: Reduces last-minute cancellations.

-

Increased Security: A portion of the payment is collected automatically at the time of booking.

-

Professional Image: A modern and efficient payment process for your customers.

-

Flexibility: You decide how high the deposit should be.

-

Fully Automated: No more manual follow-ups for outstanding payments.

With this new feature, you can manage your bookings and payments more efficiently, enhancing the experience for both you and your clients.